Xoma Acquires Turnstone Biologics in $8M Deal Amid Industry Struggles

Xoma Royalty acquires struggling San Diego biotech Turnstone Biologics for $7.9M after halted trials and layoffs. Explore the details and implications for investors and the biotech sector. In a quiet but telling development for the biotech industry, Xoma Corporation has announced the acquisition of Turnstone Biologics, a once-promising immuno-oncology company, for approximately $7.9 million. The […]

Xoma Royalty acquires struggling San Diego biotech Turnstone Biologics for $7.9M after halted trials and layoffs. Explore the details and implications for investors and the biotech sector.

In a quiet but telling development for the biotech industry, Xoma Corporation has announced the acquisition of Turnstone Biologics, a once-promising immuno-oncology company, for approximately $7.9 million. The cash deal values Turnstone shares at $0.34 each, signaling a dramatic drop from its earlier valuation that was buoyed by strategic partnerships and investor funding.

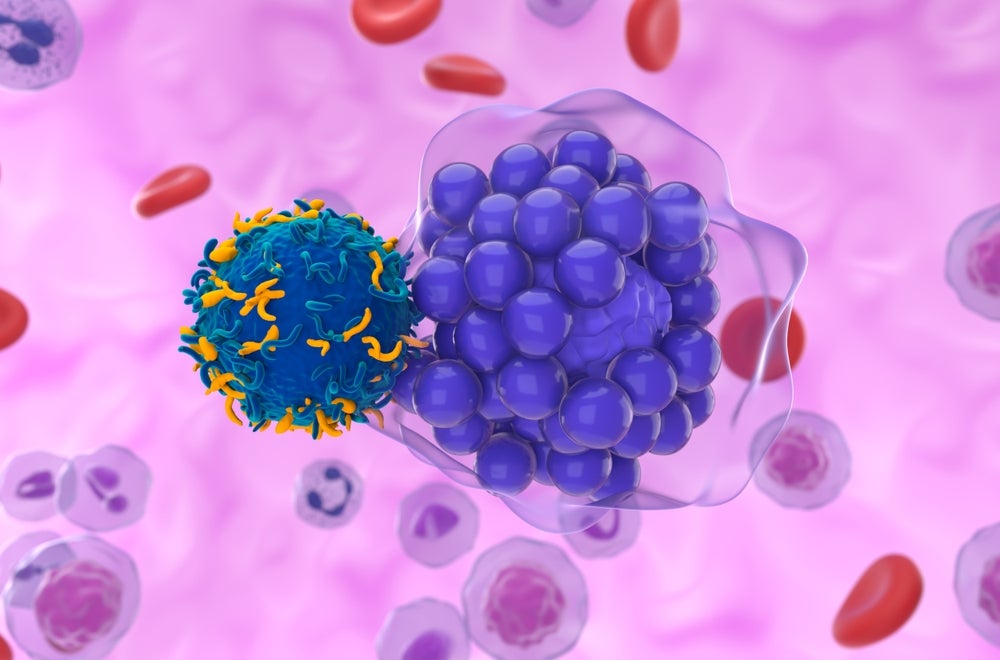

Founded in San Diego, Turnstone once held potential with tumor-infiltrating lymphocyte (TIL) therapies and strategic collaborations with AbbVie (2017) and Takeda (2019). However, by early 2024, the company was forced to halt its only clinical-stage program, citing unmanageable manufacturing costs. This led to further layoffs and the initiation of a search for “strategic alternatives,” a phrase often signaling an imminent sale or shutdown in biotech circles.

The company was delisted from Nasdaq, and with minimal cash reserves left, Turnstone no longer presented the core elements typically attractive to acquirers. Nevertheless, Xoma saw opportunity.

Xoma’s business model centers on acquiring royalty rights and milestone payments, offering upfront capital to biotech firms in exchange for future earnings. Through this acquisition, Xoma now gains:

Access to Turnstone’s TIL-based oncology pipeline

Remaining cash reserves of $21.8 million as of March 2025

A Contingent Value Right (CVR) component, which could provide future payouts to shareholders (specifics not disclosed)

Turnstone’s collaborations with AbbVie and Takeda were seen as validation of its scientific direction. However, AbbVie discontinued its partnership in 2019, and Takeda formally terminated its agreement before the end of 2024. These developments contributed to a sharp decline in investor confidence.

Turnstone’s lead compound was in a Phase 1 trial for solid tumors but never progressed further, a reality that reflects broader trends in biotech where manufacturing scale-up costs and clinical trial expenses can stymie even well-funded startups.

This acquisition marks a modest win for Xoma, which continues to consolidate biotech royalty streams, but a sobering end for Turnstone, which once raised substantial hopes in cancer immunotherapy. For biotech investors, this deal underscores the importance of clinical and manufacturing viability, not just early promise.

What's Your Reaction?