Semaglutide: a price and HTA comparison between US and top European markets

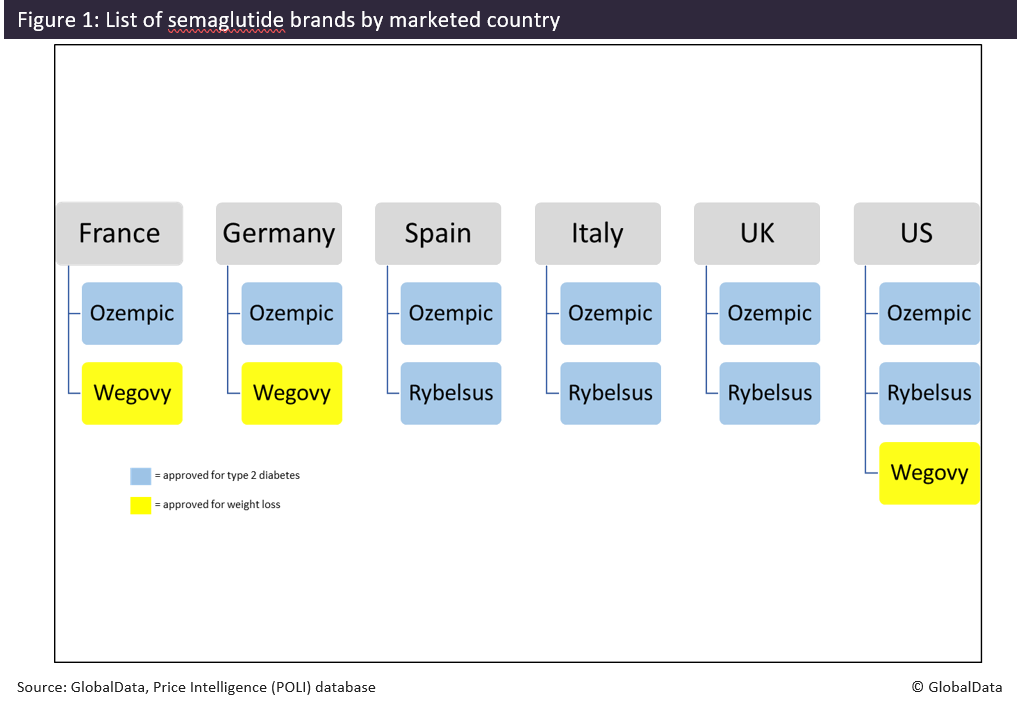

The US is known for having higher list prices for drugs than other high-income countries. But these higher prices have not deterred investment and US patient usage of diabetes/weight-loss drugs, such as semaglutide. While Medicare is not allowed to cover weight loss drugs under current law and Medicaid coverage varies by state, the US, like its counterparts in Europe, is seeing an increased interest in these drugs. GlobalData has therefore analysed the price differences between the popular drug, semaglutide, in the US, compared to the top five European markets (France, Germany, Italy, Spain and the UK). Other factors considered include how the average first price change is seen in each market, the time to first price change, and how respective health technology assessment (HTA) outcomes vary between semaglutide brands and all drugs indicated for the treatment of obesity or diabetes across the Europe top five and the US. Launch cost lower in the top five European markets Semaglutide was first launched in the US in December 2017 by Novo Nordisk, under the brand name Ozempic, for the treatment of type 2 diabetes and as an “add on” to other diabetes medicines, at a manufacturer price of $676.00. It is currently the only brand of semaglutide available in all top five European markets and the US. Along with the drug’s increased popularity and expanded use, including off-label treatments for weight loss, other brands of semaglutide were then launched by Novo Nordisk under the names Rybelsus and, most recently, Wegovy. Of the semaglutide brands, only Wegovy has been approved for weight loss, together with diet and physical activity. It is not uncommon for an active ingredient that has been used for an off-label indication to then be approved under a different brand with a higher price. GlobalData has compared the average daily cost at launch of these different brands of semaglutide across the top five European markets and the US based on a defined daily dose (DDD) of 0.11mg for those brands delivered parenterally (Ozempic and Wegovy) and 10.5mg for the orally administered Rybelsus. While the daily dose for Wegovy is higher in practice, 0.11mg was used to allow for a direct comparison of the two semaglutide products that have the same dosage form. For the US, the “Big 4” and wholesale acquisition cost (WAC) prices were used to calculate the daily cost. Since the Big 4 price is the maximum price a manufacturer can charge the big four federal agencies (Department of Veterans Affairs [VA], the Department of Defense [DoD], the Public Health Service, and the Coast Guard), it offered a price control measure comparable to that of the reviewed European markets. All three products achieved their highest average daily cost at launch in the US, ranging from $16.77 for Ozempic to $45.55 for Wegovy. Compared to the US, the average daily cost of Ozempic at launch in the top five European markets ranged between 183% and 267% lower, with the lowest in France at $4.56. The most recent version of semaglutide, Wegovy, has the highest daily cost at launch of a semaglutide product in each of its markets (France, Germany and the US). However, its daily cost in France was still 143% lower than its daily cost at launch in the US, and even lower in Germany - 572% lower when compared to the US. Wegovy’s lower cost in Germany compared to the other European markets is likely due to the drug not being reimbursed there. A decision to compensate a lower price for a higher volume of sales may therefore have been made. It is worth noting, however, that a direct comparison cannot be made between Wegovy and the other brands. While the drug is also a semaglutide product, its higher cost is justified by a higher dosage that aligns with its approval specifically for weight loss. Diabetes/obesity drugs retain launch price for longer in Europe's top-5 than the US Ozempic, Rybelsus and Wegovy have undergone price changes in at least one of these markets. According to GlobalData, Ozempic was able to maintain its launch price for the longest time in France (1,459 days) before receiving a price cut. In Figure 3, the average first price change for all drugs that have been indicated for the treatment of obesity or diabetes (including those molecules that have been genericised) across Europe's top 5 markets and the US were reviewed and compared against the average price change of Ozempic, Rybelsus and Wegovy. In France, the average price change for Ozempic (-3.69%) was significantly lower than the overall average for all diabetes/obesity medicines (-9.68%). A similar trend is seen in Spain, where Ozempic took a price cut of only 6% compared to the overall average of 13.84%. In Germany, Ozempic took a much greater cut (-21.17%) when compared to the overall average for diabetes/obesity drugs (-11.87%). After launching in Italy, Ozempic saw a different trend, however, and received a price increase of 5.27% while on aver

What's Your Reaction?